Easy Variable Universal Life Insurance 2025

What is a Variable Universal Life Insurance Policy?

Variable Universal Life Insurance (VUL) is a type of permanent life insurance that combines the flexibility of universal life insurance with an investment component. Key features include:

- Flexible Premiums: Policyholders can adjust premium payments within certain limits.

- Cash Value Growth: A portion of the premium is allocated to a cash value account, which is invested in various sub-accounts (similar to mutual funds).

- Death Benefit: Offers a death benefit to beneficiaries, which can be adjustable based on the policy’s terms and cash value performance.

- Investment Options: You can invest your cash value in various investment options, such as mutual funds, stocks, or bonds.

- Tax-Deferred Growth: The cash value grows tax-deferred, meaning you won’t pay taxes on the gains until you withdraw them.

What are the Tax Benefits of VUL?

Please go through given points below one by one :

- Tax-Deferred Growth: The cash value grows tax-deferred, meaning you don’t pay taxes on the investment gains until withdrawal.

- Tax-Free Death Benefit: Beneficiaries typically receive the death benefit income-tax-free.

- Policy Loans: You can borrow against the cash value without triggering a taxable event if the policy remains in force.

- Tax-Free Loans: You can borrow against the cash value of your VUL policy, and the loan proceeds are tax-free. The interest payments on the loan are not deductible, but the loan itself is not taxable.

- Tax-Free Withdrawals: You can withdraw from the cash value of your VUL policy tax-free, up to the cost basis (the amount you’ve paid in premiums). Any growth above the cost basis can be withdrawn tax-free, as long as the policy remains in force.

What are the Benefits of VUL?

Based on finance here are some benefits of it:

- Investment Options: Policyholders can choose from various sub-accounts to invest in, offering growth potential.

- Flexibility: Adjust premiums and death benefits as financial needs change.

- Dual Purpose: Combines life insurance with investment opportunities.

- Estate Planning: Helps transfer wealth to beneficiaries tax-efficiently.

Variable Universal Life Insurance Example:

Imagine a 35-year-old policyholder investing $500 monthly in a VUL policy. The premium is split into:

- Insurance Costs: $150 to cover the death benefit.

- Cash Value Investment: $350 allocated to sub-accounts like stocks and bonds. If the investments perform well, the cash value grows, enhancing the policy’s worth and potentially increasing the death benefit.

Policy Details

- Policyholder: John, age 35

- Face Amount: $500,000 (death benefit)

- Premium: $5,000 per year

- Investment Options: John chooses to invest his cash value in a mix of stocks, bonds, and mutual funds

- Interest Rate: 4% interest rate on the cash value

Year 1

- Premium Payment: John pays $5,000 in premiums

- Cash Value: $5,000 (initial premium payment)

- Investment Earnings: $200 (4% interest on cash value)

- Total Cash Value: $5,200

Year 5

- Premium Payments: John pays $5,000 per year for 5 years

- Cash Value: $25,000 (total premium payments)

- Investment Earnings: $5,000 (4% interest on cash value, compounded annually)

- Total Cash Value: $30,000

Year 10

- Premium Payments: John pays $5,000 per year for 10 years

- Cash Value: $50,000 (total premium payments)

- Investment Earnings: $20,000 (4% interest on cash value, compounded annually)

- Total Cash Value: $70,000

Variable Universal Life Insurance: Pros and Cons

Pros:

- Flexible premium payments and death benefits.

- Investment growth potential.

- Tax advantages on cash value and death benefit.

Cons:

- High fees (administrative, insurance costs, fund management).

- Investment risk (poor market performance can erode cash value).

- Complexity in managing investments and understanding policy terms.

- Premium Increases: Premiums may increase over time, depending on the policy’s performance.

Best Variable Universal Life Insurance

Top providers often include:

- Prudential: Known for a wide range of investment options.

- Northwestern Mutual: Offers strong customer support and stable performance.

- New York Life: High financial ratings and robust policy customizations.

- Transamerica: Competitive fees and flexible policies.

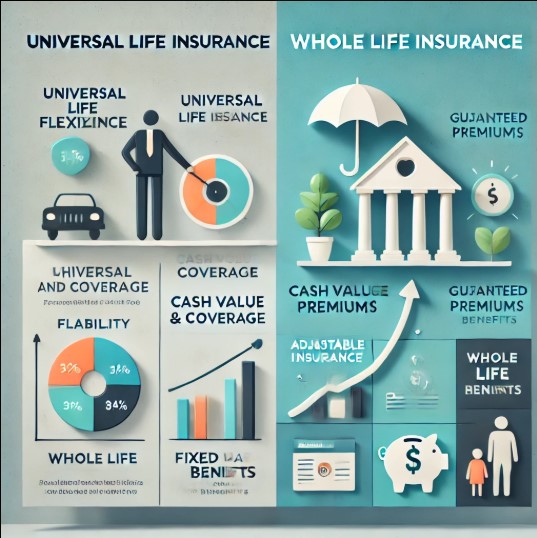

Variable Universal Life Insurance vs. Whole Life

| Feature | Variable Universal Life (VUL) | Whole Life |

| Investment Component | Yes, policyholder chooses sub-accounts | No, fixed interest rate |

| Premium Flexibility | Adjustable | Fixed |

| Cash Value Growth | Depends on investment performance | Guaranteed growth |

| Risk Level | High | Yes, the policyholder chooses sub-accounts |

Variable Universal Life Insurance vs. Universal Life

| Feature | Variable Universal Life (VUL) | Universal Life |

| Investment Options | Multiple sub-accounts (higher risk) | Fixed interest (low risk) |

| Cash Value Growth | Market-dependent | Fixed, steady growth |

| Complexity | High | Moderate |

Who is it Suitable For?

VUL policies are suitable for individuals who:

- 1. Want a permanent life insurance policy with a death benefit?

- 2. Are willing to take on investment risk to potentially grow their cash value.

- 3. Need flexibility in their premium payments and investment options.

- 4. Are looking for tax-deferred growth.

You may like to read about Mind health coverage.

You can also read the best 10 health insurance plans by clicking here.

You can also read about Smart budgeting tips for 2025 by clicking here.

You can also share your own views in the comments or write us @hevensh05@gmail.com and we would be really glad to share information and views on our website.